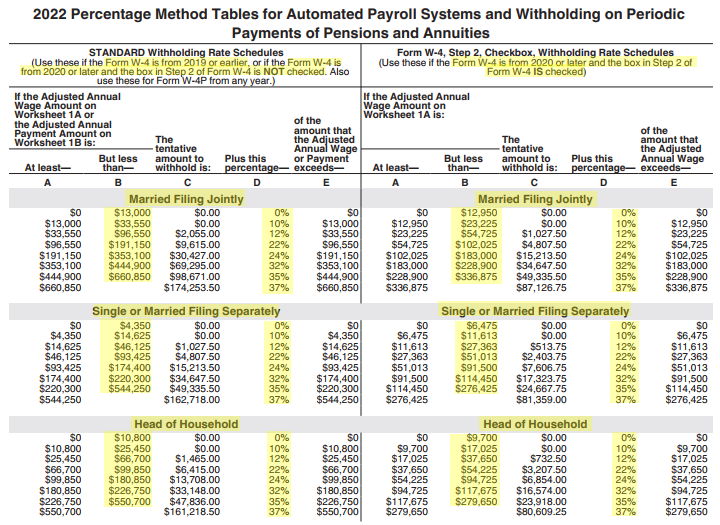

Mississippi Withholding Tax Tables 2024. Mississippi state income tax calculation: Mississippi withholding for payroll 2024 the table used here is the percent method.

To estimate your tax return for 2024/25,. There is no tax schedule for mississippi income taxes.

These Rates Are The Same For Individuals And Businesses.

To estimate your tax return for 2024/25,.

It Is More Accurate Than The Table Method And It Is An Exact Tax Calculation.

As an employer, you also.

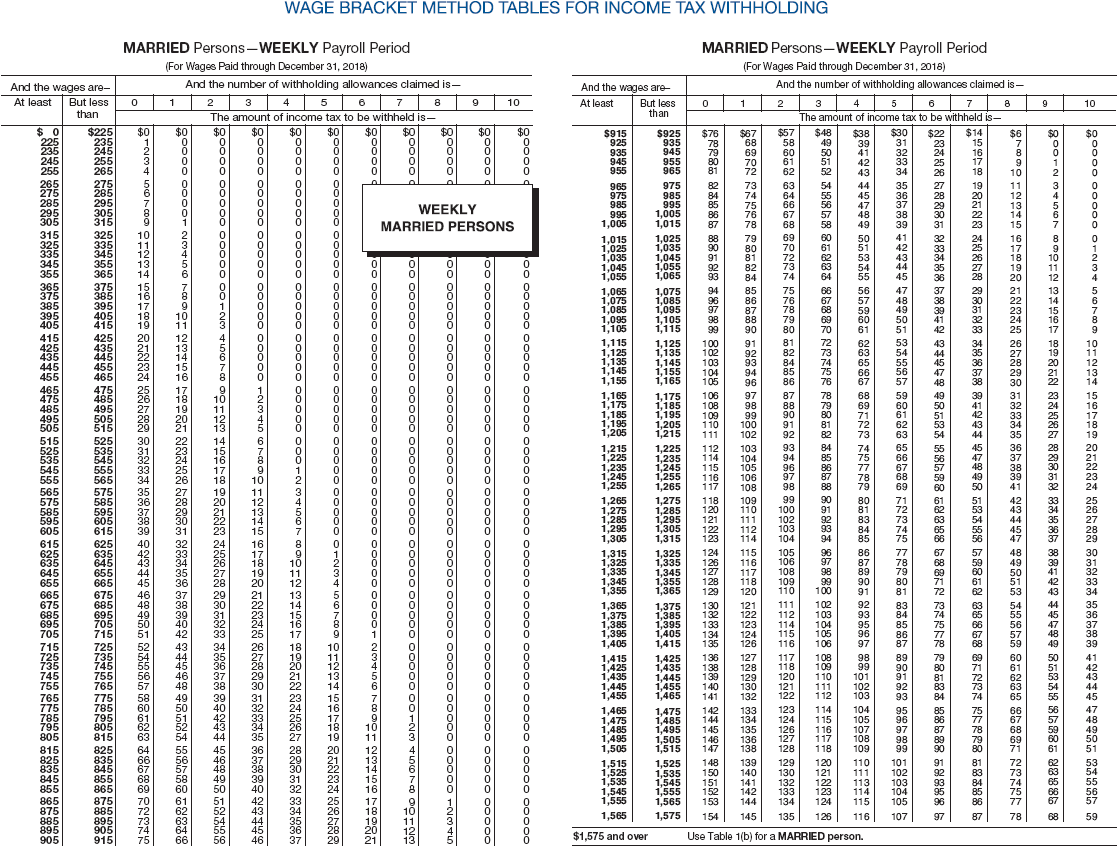

The Percentage Method And Wage Bracket Method Withholding Tables, The Employer Instructions On How To Figure Employee Withholding, And The.

Images References :

Source: www.pixazsexy.com

Source: www.pixazsexy.com

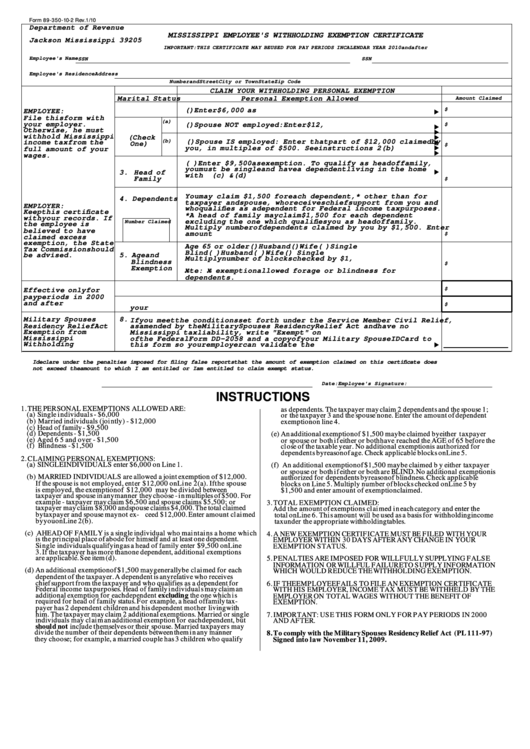

Tabelas Anuais De Irs 2023 Withholding Certificate 8288 Instructions, Mississippi state income tax calculation: The withholding tables are based on various factors, including pay periods, filing status, employee wages (tax brackets), exemptions, and tax credits.

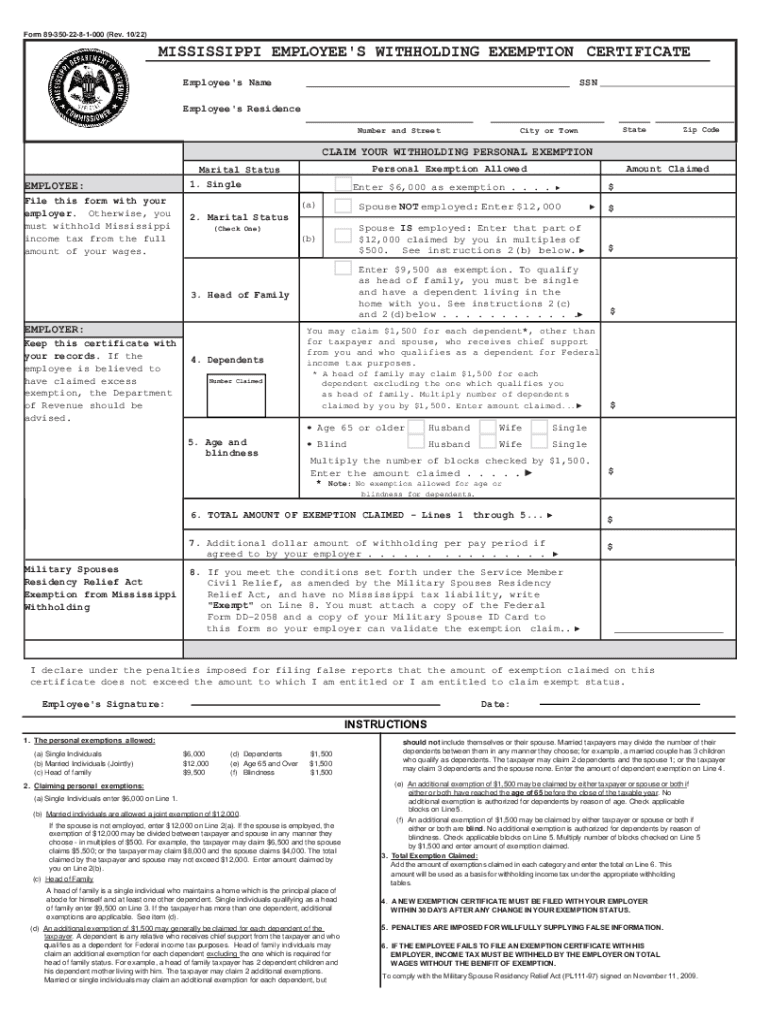

Source: printableformsfree.com

Source: printableformsfree.com

Ms Employee Withholding Form 2023 Printable Forms Free Online, Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year. Multiply the adjusted gross biweekly.

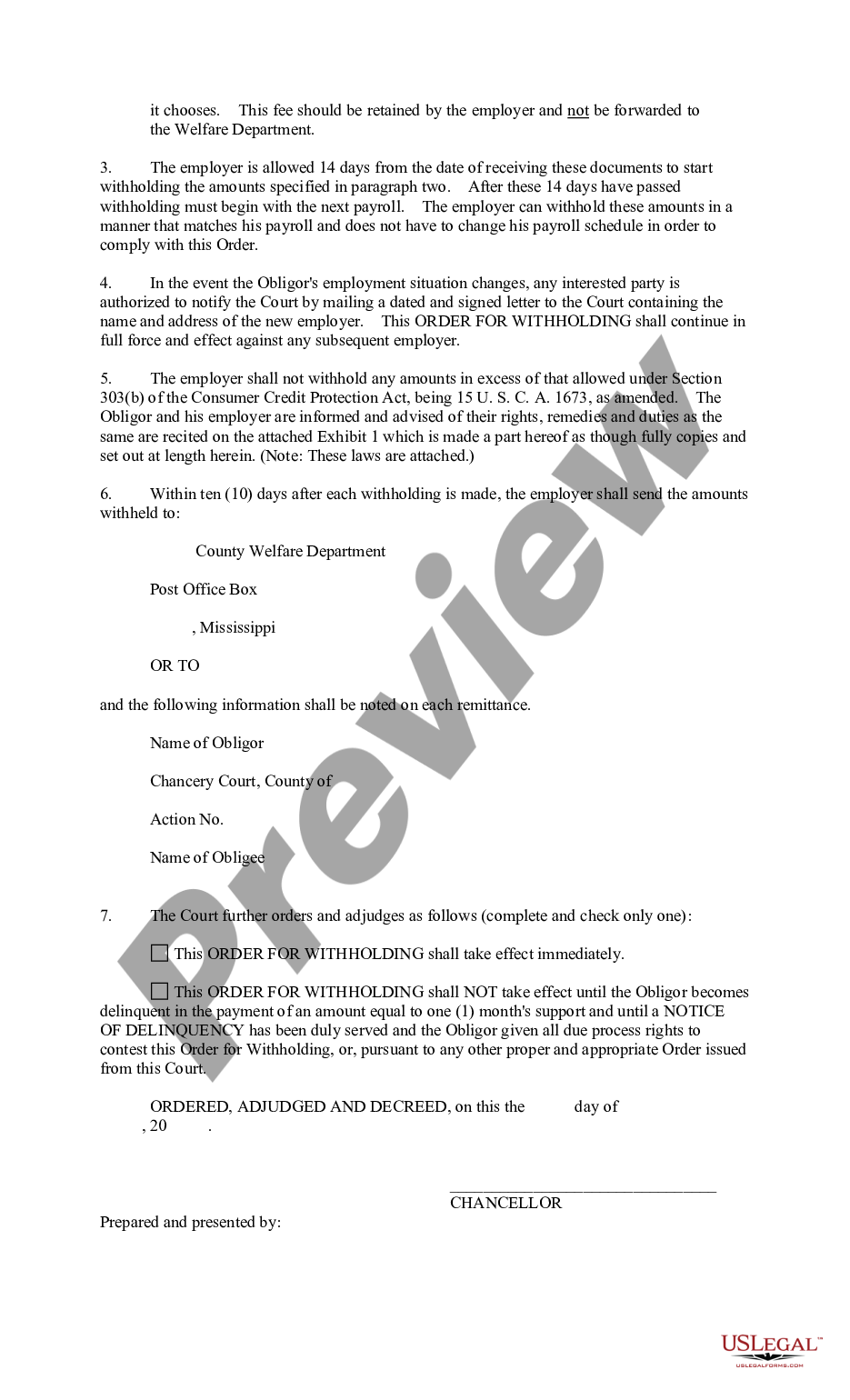

Source: www.uslegalforms.com

Source: www.uslegalforms.com

Mississippi Order for Withholding Mississippi Withholding US Legal, The graduated 2023 income tax rate is: Compared to the 2021 formula, the number of tax brackets.

Source: awesomehome.co

Source: awesomehome.co

Federal Tax Withholding Tables Weekly Payroll Awesome Home, Key features include detailed calculations for federal. Any salary above $168,600 is exempt.

Source: www.formsbank.com

Source: www.formsbank.com

Top 8 Mississippi Withholding Form Templates free to download in PDF format, There is no tax schedule for mississippi income taxes. To estimate your tax return for 2024/25,.

Source: www.chegg.com

Source: www.chegg.com

Lake Community College gives its faculty the option, Mississippi's 2024 income tax brackets and tax rates, plus a mississippi income tax calculator. The percentage method and wage bracket method withholding tables, the employer instructions on how to figure employee withholding, and the.

Source: brokeasshome.com

Source: brokeasshome.com

State Of Ohio Employer Withholding Tax Tables, As an employer, you also. Mississippi's 2024 income tax brackets and tax rates, plus a mississippi income tax calculator.

Source: www.signnow.com

Source: www.signnow.com

Mississippi Withholding 20222024 Form Fill Out and Sign Printable, It is more accurate than the table method and it is an exact tax calculation. Compared to the 2021 formula, the number of tax brackets.

Source: addyqmeriel.pages.dev

Source: addyqmeriel.pages.dev

Washington Tax Brackets 2024 Collie Katleen, Withholding formula > (mississippi effective 2024) < subtract the biweekly thrift savings plan contribution from the gross biweekly wages. Mississippi's 2024 income tax brackets and tax rates, plus a mississippi income tax calculator.

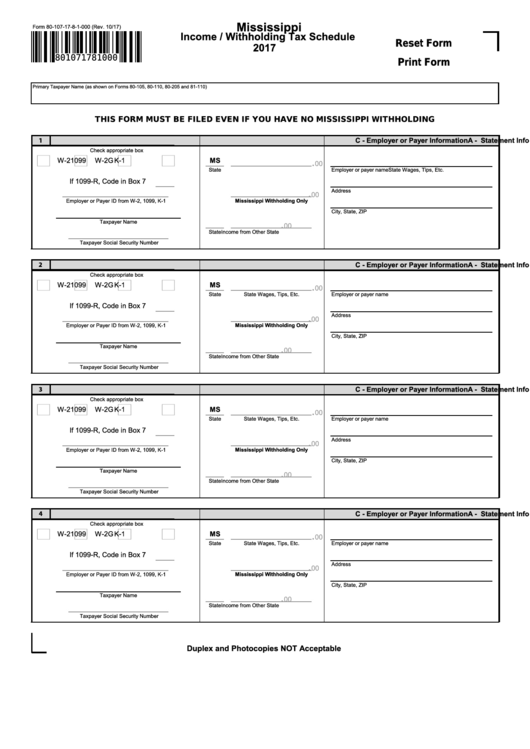

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form 80107 Mississippi / Withholding Tax Schedule, The graduated 2023 income tax rate is: The mississippi state tax calculator (mss tax calculator) uses the latest federal tax tables and state tax tables for 2024/25.

Tax Rates And Income Thresholds.

Mississippi’s 2022 withholding formula was released jan.

For The Tax Year 2024, The Top Tax Rate Is 37% For Individual Single Taxpayers With Incomes Greater Than $609,350 ($731,200 For Married Couples Filing Jointly).

The mississippi tax calculator for 2024 encompasses a comprehensive suite of features to cater to your tax calculation needs.